It’s OK to be Expensive, Just Don’t Be Overpriced

I made an unusual social media post this week with a scary-looking mathematical formula for calculating “EOQ.” When I…

Capitalizing on the Predicted Market Rebound: A Guide for Business Buyers and Sellers

With the chance of the economy bounce back, smart business folks are looking at ways to buy or sell…

How Businesses that Service the Housing Market Keep our Economy Rolling

Building Houses, Creating Jobs: How it Helps Everyone Did you know, businesses that service homes are more than just…

Unveiling the Buy Low, Sell High Strategy

Ever heard of the saying “Buy low, sell high”? It’s not just a catchy phrase – it generally refers…

Should I buy a business or start one?

Why would you buy an existing business and not launch a new one? Find out! Buy a business or…

How to find a business to buy?

You’re ready. You want to jump right into an operating business, and keep it running – even improve it….

What is cash flow? Tips for Buying a Business

You need to know the cash flow of a business BEFORE you buy it. Let’s break it down. Cash…

How to pick a trademark name for my business

What is your business named? Do you have it registered as a trademark? All businesses that are going nationwide…

Work Full-Time, Prioritize Family, and Start a Business: Your Business Startup Tips

Starting a business while managing family responsibilities and a full-time job may seem tough. And it is! If: …You’ve…

What it’s Like to Sell Your Business (Webinar Video)

Selling your business is exciting and scary. The dream of a big check captures many founders’ minds. Sadly, deals often fall through or are far more difficult than necessary. Attorney Matthew Nuzum will explain the process of selling your business.

How do I get my first customers?

It’s a common struggle for new business owners who have launched a business. They need customers but their social…

Service Animal Fraud is Criminal in Iowa

A service animal is an unclear term in the U.S. because different parts of the law use different terms…

4 Types of Intellectual Property: Securing Your Business Benefits

Did you know that finding success in today’s fiercely competitive business landscape requires protection of your ideas, inventions, and…

Make Taxes Suck Less: 4 Practical Tips for Small Business Owners

Tax planning can be overwhelming. If you’re wondering what taxes a small business has to pay, which deductions my…

Why are service marks and trademarks important for business?

Establishing a strong brand identity is one of the most important actions you can do to ensure success in…

Emma’s Enchanting Encounter: The Tale of a Trademark Triumph

Once upon a time in a quaint little town, there lived a passionate baker named Emma. Emma had spent…

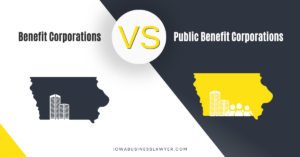

Benefit Corporations vs Public Benefit Corporations in Iowa

An Iowa benefit corporation is a for-profit corporation with a purpose to help the public, while a public benefit corporation is a charitable non-profit corporation.

Safeguard Your Startup: Why Registering a Trademark is Essential for Tech Entrepreneurs

Another company is using my name! We worked with a business owner who had a competitor start a business…

Caring about Small Businesses – Entrepreneurship in Our Genes

Why do we on the Iowa Business Lawyer team care so much about small businesses? Well, small business ownership…

Free Event – Biennial Report Help 2023

Free help for Iowa LLC owners—every other year you have to file a biennial report. If you’d like help,…